Square – Serial Innovation

This post is also available in: Portuguese (Brazil)

In 2009, Jack Dorsey (from Twitter) started to work in a new project after hearing that a friend was unable to complete a sale because couldn’t accept credit card as payment. In May 2010 he launched Square.

In 2009, Jack Dorsey (from Twitter) started to work in a new project after hearing that a friend was unable to complete a sale because couldn’t accept credit card as payment. In May 2010 he launched Square.

Square is a service that allows anyone to receive credit card payments. Without having a business or a merchant account. Imagine various freelancers, small business and everyone taking credit card. Square has a great market potential.

Earlier this year I’ve joined the service. You can just download the app (iOS or Android) and receive the card reader at home.

And that was the first innovation. The reader can get the data from the magnetic strip and transfer it to the phone throught the mic input. A simple reader, an accessible service.

Business Model? Square charges a 2.75% fee per transaction. In the United States, merchants pay a transaction fee between 0.50% and 2.25% plus monthly fees. And you have to go through the merchant account option, which may not justify the cost specially with an alternative now.

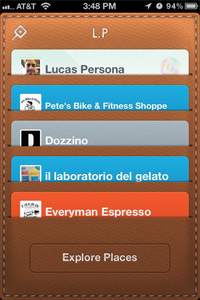

But Square didn’t stop to innovate after that. This past May (2011) they’ve launched the Card Case app for consumers, where you can register your credit card and use the app to make payments in places (Merchants) that already work with Square. It’s paying by credit card, without the card. Without even requiring the Square card reader.

As new business models appear and get traction faster than ever, it’s important to face the risk known as the Innovator Dilemma, where it lay out the great risk for a company to keep it doing business as usual even when identifying a new opportunity that may kill it’s own business.

When you hear about innovation in the payments’ field, the subject most talked about is NFC (Near Field Communication) where a chip is added to the phone (or into some credit cards) that allows it to exchange information with a reader just by getting close to it (a few inches). Google is one company betting on NFC in Android phones to be used as a payment system: Google Wallet.

So instead of taking the credit card from the pocket (and the wallet), you’d just need to take the phone from your pocket and use it to pay.

But why should we imitate the process of taking the credit card from the wallet, just swapping it for a phone, when we could just leave it where it is? Square presented this past week a new functionality in the Card Case app for Geo-referenced payments. By joining the service and opening a tab in a particular store/restaurante, when it’s time to pay I just tell my name to the cashier. My info will show up, with my picture. And the payment is processed.

But why should we imitate the process of taking the credit card from the wallet, just swapping it for a phone, when we could just leave it where it is? Square presented this past week a new functionality in the Card Case app for Geo-referenced payments. By joining the service and opening a tab in a particular store/restaurante, when it’s time to pay I just tell my name to the cashier. My info will show up, with my picture. And the payment is processed.

As I have the phone with me, Square can validate that I’m near the store (GPS) and the cashier – through my picture – can confirm that I’m the same person. To add to the security, I receive a message on my phone right away that the payment has been done. Everything without taking my phone (or credit card) out. At this point, the purchase doesn’t feel it cost anything. And that is the greatest danger of such innovation.

The best technology won’t be the one with the most Acronyms or features but the one that is transparent to us. Completely weaved in our lives. So intuitive and simple. And this simplicity can change an entire industry.